From free trade agreements to how hedge fund billionaires are taxed, Donald Trump is surprisingly right on some controversial issues.

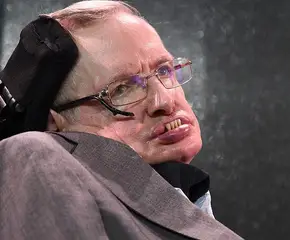

Mark Lyons/Getty Images

Given the caliber of personalities and ideas proffered in the 2016 presidential election season, it is not surprising that Donald Trump continuously occupies a space of apparent contradiction. His image is one that inspires sustained fascination and revulsion; his person has been called everything from a fascist to a RINO.

Beyond his image, his political stances — and more precisely, the ways he articulates them — have made it something of a sporting event to see just how quickly pundits can dismiss his views. But there are a few substantive issues Donald Trump understands better than any other candidate:

Medicare And The Cost Of Prescription Drugs

Roel Smart/Getty Images

Along with Bernie Sanders and Hillary Clinton, Donald Trump supports allowing the government to negotiate Medicare drug prices with drug manufacturers, which he believes has the potential to save the government $300 billion per year.

While Trump exaggerates the financial benefits of such a shift, he highlights a relationship between the state and the pharmaceutical industry which warrants scrutiny.

The federal government has been prohibited from negotiating Medicare Part D drug prices following the 2003 passage of a gargantuan Medicare prescription drug law, which some congresspeople remember as one that was written by the pharmaceutical industry. Said North Carolina representative Walter Jones:

“The pharmaceutical lobbyists wrote the bill. The bill was over 1,000 pages. And it got to the members of the House that morning, and we voted for it at about 3 AM in the morning.”

As per the language of the bill, instead of allowing the federal government to negotiate prices with drug manufacturers — as Medicaid and the Department of Veterans Affairs can do — Congress opted to let private insurers alone do the job.

Such a provision might have been fine if prices more or less stayed the same over time, or if private insurers had as much negotiating leverage as the federal government, or even if real wages increased along with prices over time — but they haven’t, and they don’t.

The result is prescription drug costs that now account for 16 percent of the 2.7 billion dollars spent on health care in 2015. Meanwhile, real wages for the average American have stagnated, meaning that prescription drug price increases are even more expensive for the average American.

Moreover, rapid prescription drug increases are now the norm. “We’re in our third year of double-digit [increases],” A.J. Loiacono of healthcare data company Truveris, told The Washington Post. “Double-digit inflation is concerning. I don’t care if it’s for gas or food; it’s rare.”

For its part, pharmaceutical companies say that price hikes are the result of investments in innovative treatments for diseases like hepatitis C, cancer and multiple sclerosis, and that if the federal government were to negotiate prescription drug prices down, fewer innovative treatments would result.

While that may be true, it is equally true that their resistance may be guided more persuasively by the bottom line — and internal data on company spending backs that up.

Nearly all major pharmaceutical companies spend more on sales and marketing than research and development. In 2013, for instance, Johnson & Johnson spent a whopping $17.5 billion on sales and marketing. As for research and development? The pharmaceutical giant spent $8.2 billion.

If the bar on federal government negotiation were lifted and low-income Medicare beneficiaries received the same discount available under Medicaid, the Congressional Budget Office says that the program would save $116 billion over 10 years, which would cut the program’s cost by around 10 percent each year.

If the Medicaid discount expanded to all Medicare Part D beneficiaries, an additional $39 billion would be saved over the same time period.

The Impact Of Free Trade Deals On The Working Class

Spencer Platt/Getty Images

In a February Republican debate, Donald Trump quipped, “We are killing ourselves with trade pacts that are no good for us and no good for our workers.” In this remark, Trump refers to the North American Free Trade Agreement (NAFTA) along with the twelve other free trade agreements that the United States has signed since 1994.

When passed, then-president Bill Clinton said that NAFTA would “[mean] jobs, American jobs and good-paying American jobs.” And while it is true that the treaty has yielded jobs in transportation, energy, and agriculture in the 20-plus years that have elapsed following its enactment, not all Americans have benefited equally from the treaty, or at all.

According to a 2014 report by consumer rights advocacy group Public Citizen, in order to get NAFTA passed, corporations including General Electric and Chrysler vowed to create a certain number of jobs. The bill passed, and these companies did create jobs, but not on American soil. Instead, these companies fired American workers and moved operations to countries like Mexico and Panama.

GE and Chrysler were not alone in transplanting production outside of America: The language of NAFTA — empowering the corporation and effectively incentivizing the outsourcing of labor and production — resulted in a massive trade deficit and job loss in the American manufacturing sector.

To make matters worse, when displaced manufacturing workers found work again, it too came at a price: According to the U.S. Bureau of Labor Statistics, two out of every three displaced manufacturing workers rehired in 2012 experienced wage reductions, many of which were more than 20 percent.

Likewise, while it is true that NAFTA has made certain consumer goods cheaper, they are not cheap enough to offset the wages lost under NAFTA. According to the report, “U.S. workers without college degrees (which constitute a majority of the workforce) likely have lost a net amount equal to 12.2 percent of their wages under NAFTA-style trade even after accounting for gains from cheaper goods.”

As AFL-CIO policy director Thea Lee told PBS Newshour:

“[NAFTA’s] been very good for protecting the interests and concerns of the multinational corporations, so that they can move their production, their jobs, around from country to country with very few obstacles. And it’s not so good for the people left behind. Almost all the benefits are going to the folks at the top, and increasingly at the very, very top, like the 0.1 percent of the top of the income distribution.”

It is likely the case that the demand for American manufacturing jobs were already falling by the time NAFTA was passed, but that is not necessarily the point Trump makes. What he says, and what others worry about as the Trans Pacific Partnership inches closer to ratification, is that these trade agreements seldom have the average American worker in mind as their primary beneficiary; rather, as Trump contends, these agreements use the power of the state to privilege a global economic elite while demanding that the American worker simply adapt to the consequences of less jobs and lower wages.

Why Wall Street Hedge Funds Pay So Little Taxes

Jayson Photography/Getty Images

While Trump has been known to engage in some less-than-noble business deals of his own, he’s wasted no time in highlighting the ways hedge funds manipulate the tax code to avoid paying taxes.

In an August 2015 phone interview with CBS’s “Face the Nation,” Trump dismissed hedge fund managers as mere “paper pushers” who “[get] away with murder” when it comes to paying taxes.

“The hedge fund guys didn’t build this country,” Trump said. “They make a fortune. They pay no tax. It’s ridiculous, OK?”

Trump is right: A provision in the U.S. tax code known as the “carried interest loophole” allows private equity and hedge fund managers to pay taxes on investment earnings at the capital gains rate instead of the ordinary income rate.

Given the amount of money these individuals rake in from investments each year, many would fall in the top income bracket, meaning they would pay an income tax rate of 39.6 percent. Capital gains rates, however, cap at 20 percent — and that’s before other tax write-offs — meaning that hedge fund managers pay at most half of what they would in taxes if taxed at the ordinary income rate.

In real terms, this means that in many cases, hedge fund billionaires and millionaires pay proportionately less in taxes than middle-class Americans.

That’s precisely something Trump says he’d like to see changed, if elected president. “These guys are getting away with murder,” Trump said. “I want to lower the rates for the middle class.”

Defendants of the carried interest rate say that it encourages long-term investment. “This tax policy encourages the risk taking that is required to start and grow companies,” the Private Equity Growth Capital Council says on its website.

“Changing the taxation of carried interest would upend a long-standing, successful policy that has helped America prosper for more than 100 years.”

But closing the loophole would also lead to prosperous outcomes, and from which more could benefit: If this loophole were closed, the state of New York alone would increase tax revenue by $3.7 billion, according to a recent Hedge Clippers report.

For more on Donald Trump, see our other pieces on his unbelievable quotes and the dark clouds hanging over Trump’s business dealings.