During the Cold War and especially after the construction of the Berlin Wall in 1961, many parts of the world had few ways of fully ascertaining what life was like in East Germany. Indeed, the Eastern Bloc state was isolated from the West in both the physical and ideological sense for decades.

Today however, decades after the wall’s 1989 demolition, photographers from behind the Iron Curtain have been able to disseminate, via the Internet, images of this “closed” life in the East to the public, giving us visual insights into the many differences — and similarities, at least superficially — between East German and Western life:

A pantomime theater group eats on a rooftop in East Berlin, 1984.Thomas Hoepker/Magnum Photos

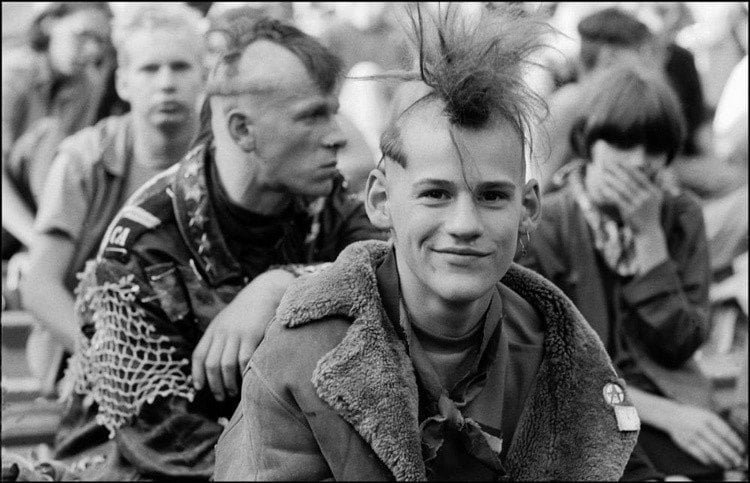

A German punk youth in East Berlin, 1984.Thomas Hoepker/Magnum Photos

May Day celebrations take place at Karl Marx Allee in East Berlin, 1974.Thomas Hoepker/Magnum Photos

World War II ruins in East Berlin display the words "never war again" in graffiti, 1974.Thomas Hoepker/Magnum Photos

Armed guards watch over a public soccer event to make sure the hooligans in the crowd do not get out of hand.Harald Hauswald

Three men riding public transit look dreary from a long day on the job.Harald Hauswald

Anti-Nazi graffiti on a wall in an East German city, 1990.Thomas Hoepker/Magnum Photos

A group of female performers dancing for the audience at Friedrichstadt Palace in East Berlin, 1984.Thomas Hoepker/Magnum Photos

An abandoned train car covered in graffiti on the streets of Prenzlauer Berg, 1974.Thomas Hoepker/Magnum Photos

During an airshow in Magdeburg in 1974, a soldier and his girlfriend spend some personal time together.Thomas Hoepker/Magnum Photos

Actors sit in the cafeteria of East Berlin's Berliner Ensenble theater, 1974.Thomas Hoepker/Magnum Photos

A "hooligan" in East Berlin, 1987.Harald Hauswald

A Soviet soldier looks over an event in the medieval city center of Bautzen.Thomas Hoepker/Magnum Photos

A young girl walks through the streets of Quedlinburg, 1974.Thomas Hoepker/Magnum Photos

The Betriebskampftruppen paramilitary group marches through East Berlin, 1974.Thomas Hoepker/Magnum Photos

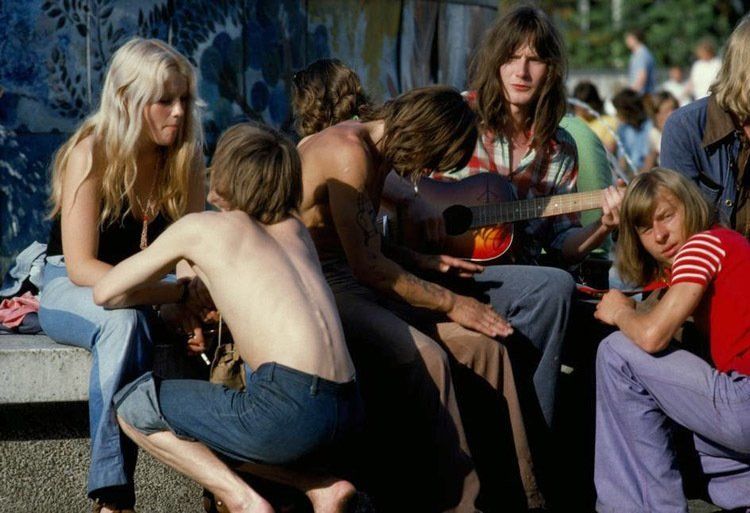

A group of teens sit around a fountain in East Berlin, circa 1970s.Thomas Hoepker/Magnum Photos

A man rests under the dandelion fountain in Dresden, in the city center of Prager Strasse.Thomas Hoepker/Magnum Photos

A rally celebrating the 25th anniversary of the founding of East Germany takes place in East Berlin, 1974.Thomas Hoepker/Magnum Photos

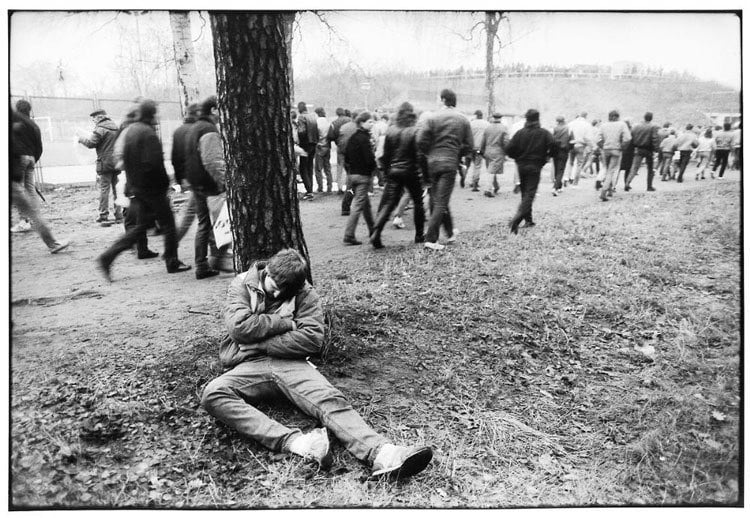

A hooligan passed out under a tree following a soccer match, while the others in attendance leave the area.Harald Hauswald

A storefront displays propaganda poster in East Berlin, 1974.Thomas Hoepker/Magnum Photos

Members of the paramilitary Betriebskampfgruppen group march in East Berlin, 1974.Thomas Hoepker/Magnum Photos

Hooligans jump a fence and rush the field after a closely fought soccer match.Harald Hauswald

Young men in a rainstorm with German flags at Alexanderplatz Square in East Berlin.Harald Hauswald

A parade marking the 35th anniversary of the proclamation of East Germany held at the Karl Marx Allee in East Berlin, 1984.Thomas Hoepker/Magnum Photos

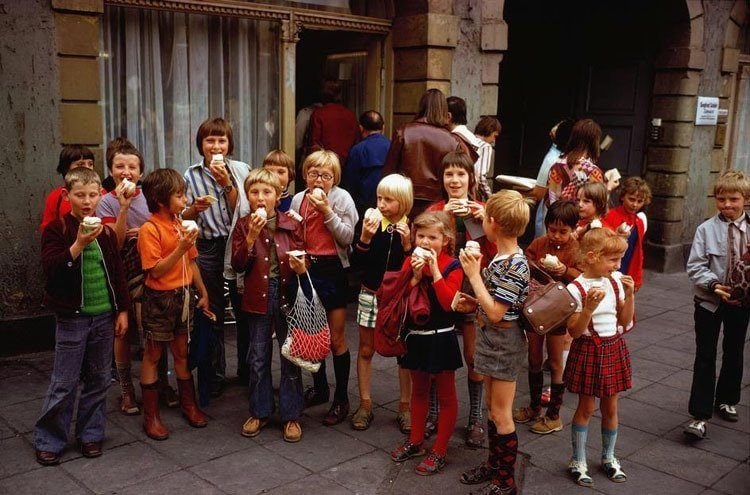

Schoolchildren on a class outing having an ice cream break in front of a shop in Erfurt, 1974.Thomas Hoepker/Magnum Photos

A Free German Youth Organization band plays in front of a statue of Vladimir Lenin in East Berlin, 1974.Thomas Hoepker/Magnum Photos

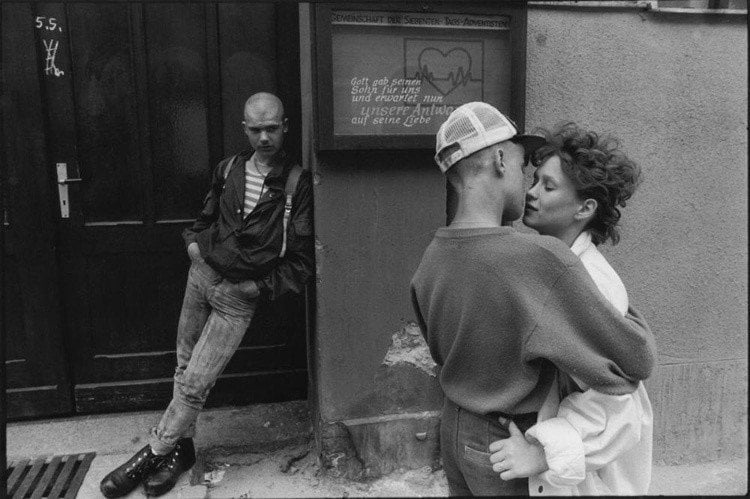

A young couple getting close on the sidewalk as a "hooligan" looks on.Harald Hauswald

A parade in East Berlin in 1959 marking the 10th anniversary of the proclamation of East Germany.Thomas Hoepker/Magnum Photos

A group of youths gathers on their motorcycles near Hoyerswerda, 1975.Thomas Hoepker/Magnum Photos

A couple out dancing. Location unknown.Harald Hauswald

Women planting potatoes in a field in 1975.Thomas Hoepker/Magnum Photos

Two men in East Berlin deliver coal to apartments in the city.Thomas Hoepker/Magnum Photos

Children playing with a soccer ball at the Berlin Wall in 1963.Thomas Hoepker/Magnum Photos

Next, take a look at this photo history of the Berlin Wall that divided East Germany from West throughout the Cold War.